Ira projection calculator

Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. While long-term savings in a Roth IRA may.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

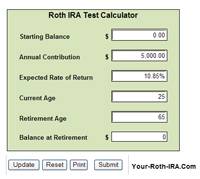

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

. Calculate your earnings and more. A Retirement Calculator To Help You Plan For The Future. As usual the header section of the heading of the sheet Traditional IRA Calculator.

This online IRA Growth and Distribution Calculator which has been updated to conform to the SECURE Act of 2019 will attempt to. If you are a company you can put your logo and company name on top. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Presuming youre not about to retire next year you desire growth and focused investments for your Roth IRA. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions. Allows chat about the three means to spend in.

The IRA was first introduced with the Employee Retirement Income Security Act of 1974 as a portable plan to allow workers to contribute to a retirement plan. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so.

Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. How is my RMD calculated. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Roth IRA Projection Calculator. Account balance as of December 31 2021. Rolling Over a Retirement Plan or Transferring an Existing IRA.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk.

Discover Bank Member FDIC. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Find a Dedicated Financial Advisor Now.

For 2022 the maximum annual IRA. The Roth 401 k allows contributions to. While long term savings in a Roth IRA may produce.

This calculator assumes that you make your contribution at the beginning of each year. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free. Save for Retirement by Accessing Fidelitys Range of Investment Options.

Discover Makes it Simple. Ad Open a Roth or Traditional IRA CD Today. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Ad Help Determine Which IRA Type Better Fits Your Specific Situation. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience.

IRA Distribution Calculator for Retirement Planning. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. This calculator has been updated for the.

Your life expectancy factor is taken from the IRS. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Using the IRA Calculator.

Do Your Investments Align with Your Goals. A 401 k can be an effective retirement tool. Roth IRA Conversion Calculator - Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same funds in your Roth IRA.

Calculate your earnings and more. Not everyone is eligible to contribute this. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

The amount you will contribute to your Roth IRA each year.

Traditional Vs Roth Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

What Is The Best Roth Ira Calculator District Capital Management

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

What Is The Best Roth Ira Calculator District Capital Management

Download Traditional Ira Calculator Excel Template Exceldatapro

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Ira Growth And Distribution Calculator Retirement Planning Tool

Best Roth Ira Calculators

Roth Ira Calculators